Data-rich payments are transactions that contain additional information beyond the basic payment details, such as the amount, payer, and payee. This additional information may include metadata such as location, time, and even behavioural data. Data-rich payments are increasingly important in the payments industry due to their ability to enhance transaction security, improve customer experience, and provide valuable insights for businesses.

One of the most significant benefits of data-rich payments is enhanced transaction security. By collecting additional data, such as location and device information, payment providers can more effectively detect and prevent fraudulent transactions. For example, if a payment is made from a device that has never been used before or from an unusual location, the payment provider can flag the transaction for further investigation. This can help reduce the risk of fraud and protect both consumers and businesses.

Data-rich payments also have the potential to improve customer experience.

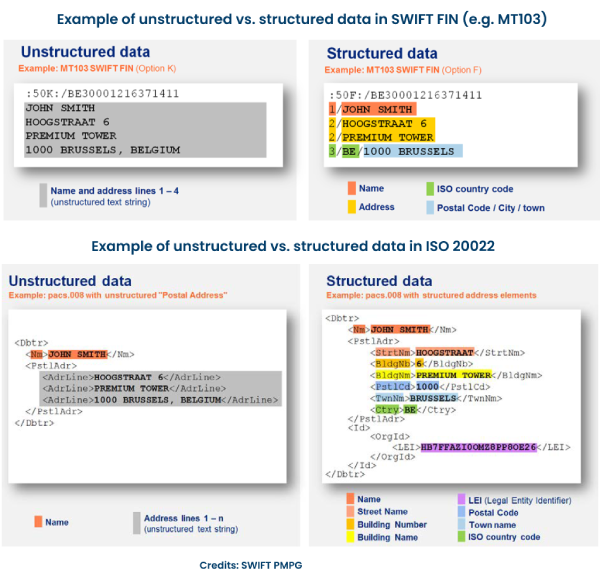

ISO 20022 standards for interbank payments (pacs.008.001.08) and payments between companies and banks (pain.001.001.09) allow for the transmission of addresses in two different forms: structured and unstructured. Structured addresses are split into 14 different tags, allowing for easy and quick processing by computerized control programs. In contrast, unstructured addresses allow for a maximum of seven lines of 70 characters, which is more traditional but less efficient for computerized processing.

Structured postal addresses are essential for successful cross-border payments. By having a valid, complete address, both the sender and recipient can be accurately identified, ensuring payments are directed to the correct location.

A structured address also helps to reduce the risk of fraud, as it can be used to validate the identity of the sender and recipient. Lastly, a structured address helps to reduce payment delays due to incorrect information.

The Challenge

Financial institutions, both big and small, encounter difficulties in utilizing address data for payments because of the diverse partner systems involved in collecting such information. The intricate web of systems and processes can create significant obstacles, making it hard to effectively leverage address data for payment purposes. Moreover, many financial institutions may face internal resistance to change, which can impact other areas of the company, such as invoicing, shipping, and delivery of physical posts. This resistance can stem from concerns about disruption to established processes, the cost of implementation, and potential downtime.

Addressing these challenges requires financial institutions to prioritize the implementation of efficient systems that can seamlessly integrate address data from multiple sources. This may involve the use of cutting-edge technologies, such as artificial intelligence and machine learning, to streamline data collection and improve data accuracy. By overcoming these challenges, financial institutions can enhance their payment processing capabilities, improve customer satisfaction, and drive business growth.

Nucleus -Structured Address Parser

Machine learning has revolutionized the world of payments, enabling organizations to gain a deeper understanding of their customers, manage risk, and prevent fraud. However, it's essential to ensure that the algorithms used are trained on diverse and representative datasets to prevent biases and ensure accuracy and fairness.

Enter Nucleus – Structured Address Parser, a machine learning module that has been trained on a whopping 1 billion address sets globally to map existing addresses to the ISO20022 standard. This helps ensure that all payment information is consistent and accurate.

With a focus on standardizing and validating addresses based on a set of predefined rules, Nucleus can be integrated with existing systems like ERPs, CRMs, and HRIS. This allows for a seamless exchange of address data between departments and external partners.

The benefits don't stop there. Nucleus can also validate addresses in real-time, ensuring that payments, physical posts, invoices, bank statements, and other privacy-critical documents are sent to the correct recipient.

Nucleus, powered by machine learning algorithms and MongoDB, revolutionizes payment processing in the financial industry. By design, Nucleus is ISO 20022 native, driving the global SWIFT ISO 20022 migration and also HVPS migrations like Target 2 and UK RTGS. By automating address structuring, enhancing compliance processes, and promoting interoperability, Nucleus drives efficiency, reduces operational risks, and enables organizations to stay ahead in a rapidly evolving landscape. Embrace the power of structured address parsing with Nucleus and embark on a transformative journey towards optimized payment processing.