Banks globally have realised the inherent scale and complexity of the ISO 20022 Migration; and that it requires them to test extensively in-house before asking counterparties and clients to engage in end-to-end scenario testing.

Additional Real-World challenges are around:

- Manual generation of large volumes of ISO 20022 compliant test data with corresponding FIN messages

- Validation of schemas

- Network validation of messages

- Data validation and enrichment for STP in production

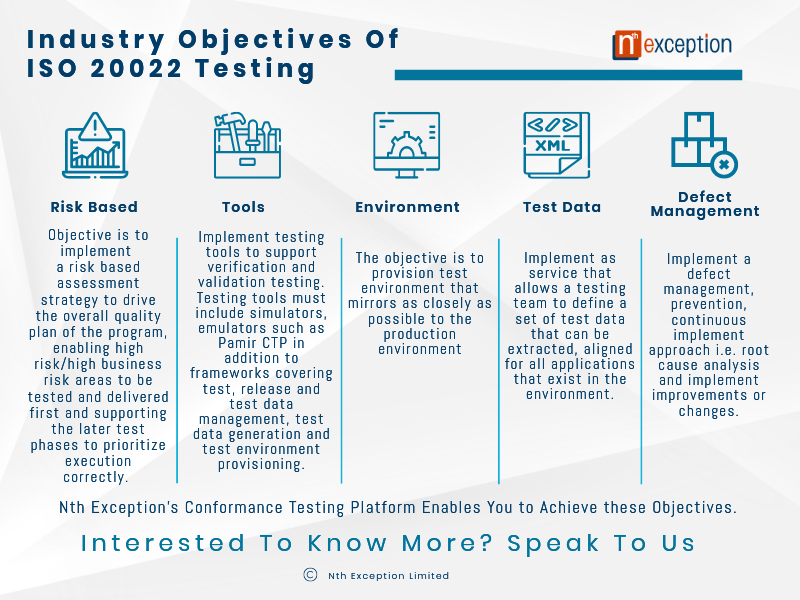

Nth Exception’s ISO 20022 Conformance Testing Platform is a purpose-built solution for generating geography-specific synthetic payment messages for ISO 20022 internal and external conformance testing.

Part of our ISO 20022 data suite, the ISO 20022 Conformance Testing Platform is a cloud-hosted self-service application or an on-premises installable that can be integrated into your existing payments testing sandboxes and test automation environments to support bank / FI transition to the new ISO 20022 payments standard.

We understand creating meaningful ISO 20022 test data for multiple scenarios is complex and time-consuming. With global ISO 20022 deadlines approaching, now more than ever it is important that banks / financial institutions and their testing partners have access to Useable test data for testing end-to-end payment flows.