In an average payments operations department, two to five per cent of all payments, made on any particular day, result in an inquiry with a value going up to billions of USD.

To improve the competitive position of their cash management offerings, financial institutions are putting increasing pressure on their payment operations. While many processing units achieve impressive straight-through processing (STP) rates, it has become clear that the cost of handling each inquiry resulting from payment is multiplied in the total payment cost.

Managing exceptions and investigations remains one of the most labour-intensive activities for a financial institution, largely because it blocks increased automation. The reason for this is the widespread use of free-format messages combined with a lack of industry rules. And as these are mostly manual processes, exceptions can consume a minimum of 6 working days to resolve in a best-case scenario.

To address this break in the payments flow, Swift has now confirmed the launch of a ‘case resolution service‘, powered by SWIFT gpi, which removes the strain involved in resolving exceptions and investigations.

The ‘in-flight’ cloud-based service allows for dynamic query handling between banks on the SWIFT network, enabling them to quickly resolve instances in which information is incorrect or missing in payment instructions.

What are the benefits of gpi case resolution?

- Improved transparency: Via the gpi Tracker, financial institutions can follow payment investigation requests anywhere in the cloud and record-related interbank communications in an audit trail

- Shorter resolution time: Financial institutions can smartly route inquiry requests using the Tracker and ensure timely follow-up backed by SLAs and a rulebook.

- Reduced manual intervention: Using structured codes in the inquiry exchanges standardizes communications. It reduces duplicate inquiries on the same payment and facilitates inquiries’ process automation by case software solutions.

How does gpi case resolution work?

Payment investigation requests are routed via the Tracker directly to the financial institution closest to the ordering customer, who will provide a response within a predefined timeframe.

Case resolution requests and interactions with the Tracker are done via API, MT n99 or GUI.

Requests and responses use standardized ISO 20022-based codes to allow automated routing and drive process automation.

Dynamic query handling between banks on the SWIFT network enables banks to resolve inquiries where operational, regulatory, or compliance information is incorrect or missing from payment instructions.

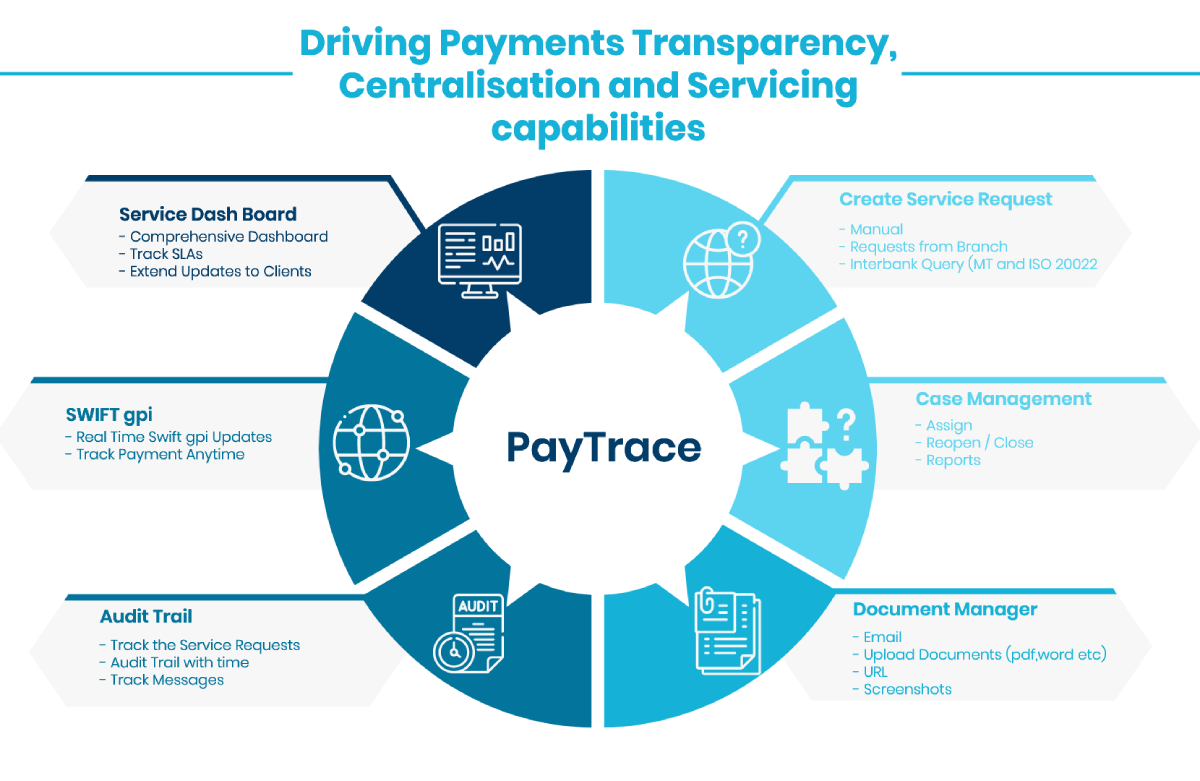

We are committed towards client-centric payment services and leading the path for other global payments innovation (gpi) initiatives.

Speak to us for more information on PayTrace.

For more details on Swift Case Resolution, visit- https://www.swift.com/news-events/news/cracking-case-how-were-simplifying-payment-exceptions-and-investigations?utm_medium=organic_social&utm_source=linkedin&utm_campaign=gpi-simplifying-payments